THE ONESEED FUND

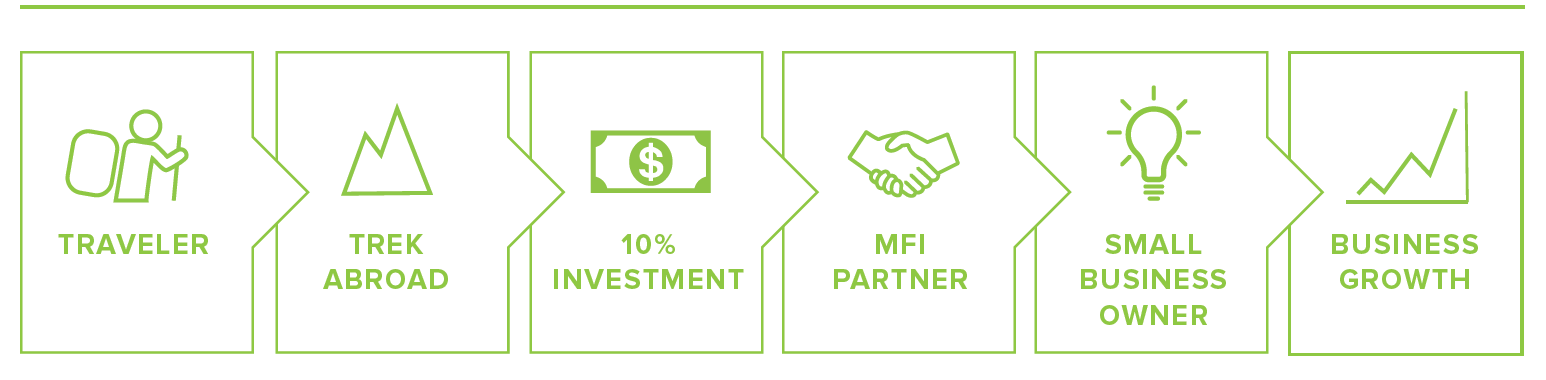

When you travel with OneSeed, 10% of your trip cost is invested in local communities through the OneSeed Fund.

The OneSeed Fund underwrites loans for local entrepreneurs to launch or grow their ideas.

OneSeed partners with local microfinance institutions (MFIs) around the world. We dedicate 10 percent of our total revenue in these partners, who in turn lend this capital to entrepreneurs as micro loans. Entrepreneurs repay the loan over the course of the loan term.

Microfinance is one tool for empowering individuals. Microloans provide an option to entrepreneurs who find it difficult, if not impossible, to obtain capital from traditional lenders.

Microfinance has been shown to empower individuals economically and socially, particularly in impoverished communities where employment opportunities are scarce. By providing essential financial services like small loans, microfinance enables entrepreneurs to start or expand their businesses, fostering self-reliance and economic sustainability.